Dynamic changes in the insurance industry require quick access to reliable information!

We are currently observing a trend of very dynamic development in the industry. The number of products insured is growing, commissions and the configuration in which products are sold often change. In order to be able to control all of this, what you need is quick access to reliable data so that the decisions you make and the plans you create are justified by facts and figures and analysis results, and not based on assumptions and hunches.

What are the most common problems in brokerage companies?

Management assistance

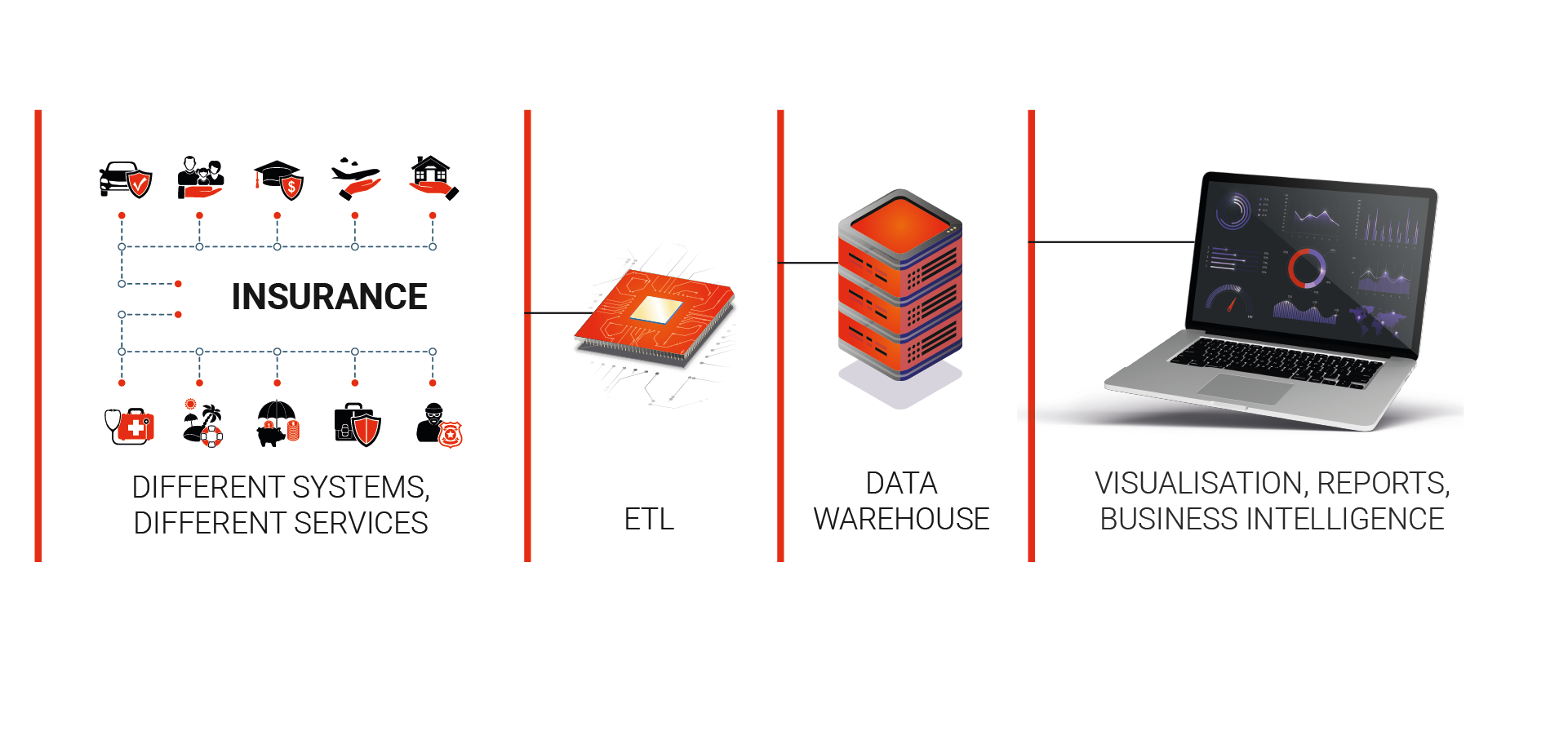

How a data warehouse solves the problem of using multiple IT systems

What analyses do you need to efficiently manage insurance?

The ability to analyse data from different systems and even different locations in one summary allows what was unattainable before the integration, namely the ability to look at the company’s operations as a whole, without dividing it into systems or locations.

The main management dashboard

The insured

Risks

Insurers

Premiums

Simulations

Individual fit

Our offer

The offer is addressed mainly to insurance companies, brokers and multiagencies. Due to the profile of our business, we are able to provide a comprehensive solution covering:

a dedicated system for recording and settling policies with the possibility of integration (e.g. with the use of network services) with the systems of insurance companies,

an advanced reporting system supporting analytical work and the process of making business decisions,

a mobile application that facilitates reaching a wide range of customers. Thanks to the mobile application, customers gain access to their user profile (my policies, premiums, dates) and also they can get acquainted with the current insurance offer and promotions.